Outline:

- Introduction

- The Rise of Digital and Neo-Banking among Gen Z

- Understanding the Institutional Exodus: What Does it Mean for Legacy Banks?

- Gen Z Shift Away from Legacy Banking and its Impact on Financial Systems

- The Changing Landscape of Banking for Gen Z

- Why Gen Z Is Turning Away from Legacy Banks

- Technological Advances and Gen Z’s Desire for Digital-First Solutions

- The Appeal of Fintech and Neo-Banking Services for Gen Z

- The Digitalization of Banking: A Paradigm Shift

- The Role of Mobile Banking Apps in Gen Z’s Financial Decisions

- The Influence of Fintech Apps Like Venmo, PayPal, and Cash App

- Digital-Only Banks: What Makes Them Attractive to Young People?

- Legacy Banks: Stuck in Tradition?

- The Limitations of Legacy Banks in Meeting Gen Z’s Needs

- Why Gen Z Perceives Legacy Banks as Slow, Bureaucratic, and Outdated

- The Costs and Inconvenience Associated with Traditional Banking

- The Rise of Neo-Banking and Its Appeal to Gen Z

- Understanding Neo-Banks: What Are They and How Do They Differ from Traditional Banks?

- Zero-Fee Banking: Why Neo-Banks Are Leading the Way in Accessibility

- Personalized Services and Financial Inclusion as Key Drivers for Neo-Banks

- The Risks of Leaving Legacy Banks: A Look at Potential Systemic Issues

- The Role of Traditional Banks in the Stability of Financial Systems

- Risks of Over-Reliance on Fintech and Digital-Only Platforms

- How a Shift Away from Legacy Banks Could Create Financial Instability

- Gen Z’s Trust in Digital Solutions: A Double-Edged Sword

- The Trust Factor: Why Gen Z Trusts Digital-Only Banks

- Cybersecurity and Data Privacy Concerns in the Digital Banking Age

- How Safe Are Gen Z’s Finances in Digital-Only Platforms?

- The Technological Innovations Shaping the Future of Banking

- Blockchain, Cryptocurrency, and the Future of Gen Z’s Financial Choices

- Artificial Intelligence and Machine Learning in Banking: What’s Next?

- How Innovations Are Changing Financial Access and Services for Gen Z

- Is Gen Z’s Exodus a Step Toward Financial Innovation?

- The Positive Impact of Gen Z’s Shift on Financial Technology

- Financial Inclusivity and Innovation: How Gen Z is Paving the Way

- The Role of Startups and Fintech in Challenging Legacy Systems

- The Impact of Gen Z’s Shift on Legacy Banks

- The Response from Traditional Banks: Adapting or Risking Obsolescence

- Legacy Banks’ Attempts to Compete with Fintech: Are They Too Late?

- How Banks Are Innovating to Stay Relevant to Gen Z Consumers

- Balancing Innovation and Systemic Risk: How to Avoid Financial Chaos

- Regulatory Concerns: Ensuring Stability in a Fast-Changing Banking Landscape

- How Governments and Financial Institutions Can Prepare for the Shift

- Balancing Innovation with Security: Finding the Right Regulatory Framework

- The Broader Economic Implications of Gen Z’s Banking Preferences

- The Long-Term Effects on National Economies and Global Finance

- How Gen Z’s Choices Are Influencing Financial Ecosystems Worldwide

- The Role of Gen Z’s Preferences in the Future of Monetary Policy

- How Gen Z is Shaping the Future of Banking

- The Digital-First Mindset: Gen Z’s Approach to Money Management

- Financial Literacy in the Age of Digital Banking: Teaching the Next Generation

- A Look at How Future Generations Will Bank: The Legacy of Gen Z’s Choices

- How Gen Z’s Financial Behavior is Challenging Financial Norms

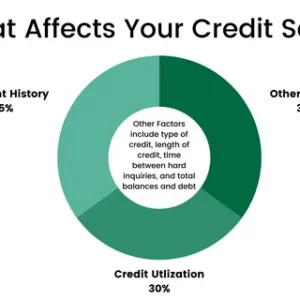

- The Rejection of Traditional Credit Models: Is Gen Z Creating a New Norm?

- Disrupting Saving and Investment Habits: New Approaches to Wealth Building

- The Future of Financial Services in a Gen Z World

- Conclusion

- Recap: The Shift Away from Legacy Banking and Its Impact on the Future

- Is Gen Z’s Exodus a Harbinger of Change or a Risky Move?

- Final Thoughts on the Evolving Financial Landscape and What Lies Ahead

- FAQs

- Why is Gen Z moving away from traditional banks?

- How are neo-banks better suited to Gen Z’s needs compared to legacy banks?

- What risks come with shifting away from legacy banking?

- How is fintech innovation reshaping the banking landscape for younger generations?

- What role does cybersecurity play in Gen Z’s trust of digital-only financial services?

READ MORE: The Hidden Emotional Toll of Budgeting in a Hyper-Comparative Economy: Overcoming Financial Stress and Digital Envy to Master Financial Discipline

The Institutional Exodus: Is Gen Z’s Bold Shift Away from Legacy Banking a Thrilling Step Toward Financial Innovation or a Looming Systemic Risk?

Introduction

Gen Z’s shift away from legacy banking marks a pivotal moment in the evolution of financial systems. While traditional financial institutions have long served as the backbone of the global economy, a new generation of digital-savvy individuals is opting for fintech solutions that promise convenience, personalization, and affordability. With the rise of neo-banks, mobile wallets, and peer-to-peer payment systems, Gen Z’s financial choices are leading to a noticeable migration from conventional banking to tech-powered financial platforms.

But what does this mean for the future of financial systems? Is this shift a step toward financial innovation, or does it pose risks to the stability and integrity of financial institutions? In this article, we explore the forces driving this institutional exodus and the impact it could have on the broader financial landscape. We will analyze how Gen Z’s banking preferences are shaping the future of the industry and whether this shift will bring about positive change or create systemic risk.

The Changing Landscape of Banking for Gen Z

Why Gen Z Is Turning Away from Legacy Banks

For Gen Z, traditional banking institutions represent a system that is outdated, slow, and unresponsive to their modern needs. Unlike previous generations, Gen Z has grown up in a world of instant information, mobile apps, and digital transactions. They expect their financial institutions to be just as agile and user-friendly as the tech platforms they use daily.

Legacy banks are often perceived as bureaucratic, complex, and inefficient in comparison to fintech solutions. For young people used to instant communication and immediate gratification, waiting in long lines at a bank or dealing with lengthy paperwork is simply not appealing. Instead, Gen Z is gravitating towards mobile banking apps and digital-first banks that promise fast, easy access to their financial information without the inconvenience of traditional banking methods.

Technological Advances and Gen Z’s Desire for Digital-First Solutions

The digital transformation of banking has opened up a world of possibilities for Gen Z. Mobile banking and neo-banks offer an entirely different experience compared to legacy institutions. These services allow for seamless transactions, no-fee accounts, and the ability to manage finances from anywhere, all with a few taps on a screen. This level of convenience aligns perfectly with Gen Z’s lifestyle, which is centered around mobility and instant access to services.

For many in Gen Z, financial apps are much more than just tools for managing money—they are essential services that enhance their daily lives. Apps like Venmo, Cash App, and Chime are not just used for payments but also offer a range of services, including savings tools, investment options, and bill splitting, all in one place. This integration of services makes traditional banks seem increasingly irrelevant to the needs of a generation that values convenience and personalization.

The Digitalization of Banking: A Paradigm Shift

The Role of Mobile Banking Apps in Gen Z’s Financial Decisions

Mobile banking apps have revolutionized the way people interact with their finances. For Gen Z, these apps represent a shift in how banking is perceived and used. With instant access to financial accounts, push notifications, and the ability to make transactions on the go, Gen Z has come to expect financial services that fit their digital-first lifestyle.

These apps not only provide the usual banking services like checking balances and making transfers, but they also integrate tools for budgeting, saving, and investing, creating an all-encompassing financial management system. The ease of use, coupled with the minimal fees, has made mobile banking apps an attractive alternative to the cumbersome processes of traditional banks.

The Influence of Fintech Apps Like Venmo, PayPal, and Cash App

Fintech apps such as Venmo, PayPal, and Cash App have gained immense popularity among Gen Z for their quick and easy money transfer services. These platforms allow users to send money instantly to anyone, without the need for complicated bank transfers or high fees. The simplicity of peer-to-peer transactions has made these apps especially popular for social and group payments, such as splitting dinner bills, sending gifts, or reimbursing friends for concert tickets.

For Gen Z, these apps represent a shift away from traditional financial institutions, which often charge fees for similar services. They prefer the free, fast, and easy services offered by fintech apps, making them a natural alternative to legacy banks that still rely on older, less efficient systems.

Digital-Only Banks: What Makes Them Attractive to Young People?

Digital-only banks like Chime, Ally, and Revolut have quickly gained traction among Gen Z for their no-fee accounts, easy-to-use apps, and fast customer service. These banks are designed for the modern consumer, offering seamless experiences and minimal friction. For Gen Z, the appeal of digital-only banks lies in their ability to offer a fully digital experience that aligns with their preference for instantaneousness and transparency.

Unlike traditional banks that may require in-person visits or lengthy account-opening processes, digital-only banks provide an instant signup and immediate access to banking services. This ease of access, combined with a user-friendly interface, makes them an ideal solution for young people who are unwilling to deal with the complexity and bureaucracy of legacy financial systems.

Legacy Banks: Stuck in Tradition?

The Limitations of Legacy Banks in Meeting Gen Z’s Needs

Legacy banks, while deeply entrenched in the global financial system, often fail to meet the needs and expectations of Gen Z. These traditional institutions are known for their bureaucratic systems, slow processes, and high fees, which are a stark contrast to the speed and convenience offered by fintech services.

For Gen Z, waiting in line at a bank or dealing with paper-based transactions is simply not acceptable. These consumers have grown up with the expectation of instant access and real-time solutions. Legacy banks, which still rely heavily on branch-based services and manual processes, are struggling to keep up with the pace of digital-first solutions offered by fintech and neo-banking services.

Why Gen Z Perceives Legacy Banks as Slow, Bureaucratic, and Outdated

Gen Z tends to view traditional banks as slow, outdated, and inefficient. Their customer experience is marred by long wait times, complicated account-opening procedures, and outdated websites that feel cumbersome compared to the sleek, user-friendly interfaces of fintech apps. Banks’ reliance on legacy systems often makes them unable to quickly implement modern technology, leaving them behind as Gen Z opts for faster, more convenient alternatives.

To Learn More, Click;

The Rise of Neo-Banking and Its Appeal to Gen Z

Understanding Neo-Banks: What Are They and How Do They Differ from Traditional Banks?

Neo-banks are a new breed of financial institutions that operate entirely online or through mobile apps, offering a digital-first experience without the traditional infrastructure and overhead costs of legacy banks. Unlike traditional banks, neo-banks provide streamlined, user-friendly services, often with lower fees and fewer requirements for account setup.

Neo-banks are typically tech-driven, relying on innovative features like real-time notifications, AI-powered financial advice, and seamless integration with digital payment systems to create a more efficient and personalized banking experience. Many neo-banks offer features such as budgeting tools, instant transfers, and zero-fee banking, making them highly appealing to Gen Z, who prioritize convenience and transparency in their financial dealings.

Zero-Fee Banking: Why Neo-Banks Are Leading the Way in Accessibility

One of the major reasons why neo-banks are so attractive to Gen Z is their zero-fee model. Many legacy banks charge fees for basic services, such as account maintenance, ATM withdrawals, or overdrafts. These fees can add up quickly, especially for individuals who are just starting their financial journeys. In contrast, most neo-banks offer fee-free banking, which can be a major draw for younger generations who are more conscious of the cost of financial services.

For Gen Z, who often have less disposable income and are seeking ways to maximize their savings, zero-fee banking is a game-changer. The ability to save money by avoiding monthly fees and service charges allows them to invest those funds elsewhere, whether in savings accounts, stocks, or crypto.

Personalized Services and Financial Inclusion as Key Drivers for Neo-Banks

Another compelling reason why neo-banks appeal to Gen Z is the focus on personalization and financial inclusion. Unlike traditional banks, which may have rigid offerings that don’t cater to the diverse needs of young consumers, neo-banks are designed with flexibility in mind. They offer customizable savings plans, tailored budgeting tools, and even financial coaching to help users make smarter financial decisions.

Moreover, many neo-banks are committed to promoting financial inclusion by offering easy access to banking for people who may not have had access to traditional financial institutions. This includes people with low credit scores, immigrants, or young adults who are just starting their financial journey. By focusing on inclusivity and personalization, neo-banks can better serve the needs of Gen Z and other underserved communities.

The Risks of Leaving Legacy Banks: A Look at Potential Systemic Issues

The Role of Traditional Banks in the Stability of Financial Systems

While neo-banks and fintech solutions provide significant advantages, it’s important to remember the role that traditional banks play in the overall stability of the financial system. Legacy banks have long been integrated into the global economy and have established mechanisms for risk management, security, and customer protection. They are also subject to strict government regulations that ensure their ability to maintain financial stability, even during economic downturns.

As Gen Z shifts toward neo-banking, there is growing concern about whether these digital-only platforms can provide the same level of security and stability. Without the regulatory oversight and safety nets that traditional banks benefit from, fintech solutions could pose risks, especially in times of economic instability. The lack of physical infrastructure and a reliance on technology can make these platforms more vulnerable to cyberattacks or systemic breakdowns.

Risks of Over-Reliance on Fintech and Digital-Only Platforms

Another concern with the shift toward digital-only banking is the over-reliance on technology. While the convenience of mobile banking apps and digital wallets cannot be overstated, they also come with their own set of vulnerabilities. For example, if a fintech platform suffers a cyberattack, users may be locked out of their accounts, losing access to their funds until the issue is resolved. Moreover, while neo-banks may offer convenience, they often lack the same level of consumer protection that legacy banks provide, such as FDIC insurance in the U.S.

If Gen Z continues to shift away from traditional banking, there’s a possibility that the overall financial system could become more fragmented. With more individuals relying on digital-only platforms, the risk of economic instability could increase, especially in times of crisis. If a large-scale disruption were to occur within the digital banking sector, it could have a cascading effect on the entire financial system.

Gen Z’s Trust in Digital Solutions: A Double-Edged Sword

The Trust Factor: Why Gen Z Trusts Digital-Only Banks

One of the biggest reasons why Gen Z is abandoning legacy banking in favor of digital-only banks is trust. Unlike older generations, Gen Z has grown up in a digital-first world, where they are comfortable using apps, streamlining processes, and managing almost every aspect of their lives through a smartphone. Trust in technology is naturally ingrained in their daily routines, from online shopping to streaming media. For this generation, digital solutions feel as reliable and secure as traditional systems — if not more so.

Additionally, neo-banks often provide a highly personalized experience and offer fast, transparent service, which builds trust with users. Features like real-time spending notifications, instant deposits, and zero fees help consumers feel in control of their finances, while the ease of access to their accounts fosters a sense of confidence and security.

Cybersecurity and Data Privacy Concerns in the Digital Banking Age

Despite the trust Gen Z places in digital solutions, there are legitimate cybersecurity concerns surrounding online-only banking. Data breaches, identity theft, and hackers targeting fintech platforms are growing risks in the digital age. Since neo-banks store vast amounts of sensitive personal and financial data on their servers, a security breach could expose users to significant financial loss or identity theft.

As digital-first platforms rise, Gen Z needs to stay vigilant about online security and data privacy. Many younger users may underestimate the importance of securing their online financial accounts, relying on the perceived security of the platforms they trust. However, as fintech companies become more mainstream, cybersecurity will continue to be a growing concern that must be addressed.

The Technological Innovations Shaping the Future of Banking

Blockchain, Cryptocurrency, and the Future of Gen Z’s Financial Choices

One of the most groundbreaking innovations affecting Gen Z’s financial choices is the rise of cryptocurrencies and blockchain technology. Blockchain promises to revolutionize the way financial transactions are conducted, offering a decentralized system that eliminates intermediaries like banks and payment processors. As a generation that values decentralization and independence, Gen Z is particularly drawn to cryptocurrencies like Bitcoin and Ethereum, which offer greater financial autonomy and the potential for long-term investment growth.

Gen Z’s growing interest in crypto and blockchain technology has sparked interest from legacy banks and neo-banks alike, with many platforms now offering crypto trading services or integrating blockchain-based solutions into their offerings. This shift signals a future where digital currencies play a central role in personal finance management.

Artificial Intelligence and Machine Learning in Banking: What’s Next?

As banks become more digital-first, artificial intelligence (AI) and machine learning are also reshaping the banking experience. These technologies enable neo-banks to provide automated financial advice, personalized spending recommendations, and enhanced fraud detection. AI can help banks analyze spending patterns and create customized savings and investment strategies for their users.

For Gen Z, AI-powered banking services align perfectly with their desire for convenience, personalization, and automation. By using machine learning algorithms, banks can offer a more tailored experience that feels more responsive to the user’s specific financial situation.

Conclusion

The shift away from legacy banking by Gen Z marks a major turning point in the financial landscape, one that brings both exciting opportunities and serious risks. On the one hand, the rise of neo-banks, mobile banking, and fintech innovations offers greater financial inclusion, personalized services, and affordable solutions. On the other hand, the systemic risks of relying on digital-only platforms and the challenges of cybersecurity could introduce vulnerabilities to the global financial system.

As Gen Z continues to embrace digital-first solutions, it’s crucial to balance financial innovation with financial security. While digital solutions offer freedom, convenience, and control, they also come with responsibilities — particularly in ensuring the safety of digital transactions and protecting personal data. Financial institutions, governments, and regulators must evolve alongside these changes to create a stable, secure, and inclusive financial ecosystem.

FAQs

- Why is Gen Z moving away from traditional banks?

Gen Z is moving away from traditional banks because of their bureaucratic processes, slow services, and high fees. They prefer digital-first banking solutions, such as neo-banks, which offer personalized services, faster transactions, and zero fees. Digital platforms cater to their need for instant access, financial autonomy, and convenience, which legacy banks struggle to match. - How are neo-banks better suited to Gen Z’s needs compared to legacy banks?

Neo-banks are better suited to Gen Z’s needs because they offer digital-first experiences with zero fees, user-friendly mobile apps, and personalized services. They also cater to the values of financial transparency, simplicity, and quick access to services, which aligns with the preferences of younger, tech-savvy consumers. Unlike legacy banks, neo-banks provide convenience and accessibility without the burdens of in-person visits or complex paperwork. - What risks come with shifting away from legacy banking?

The risks of shifting away from legacy banks include the lack of regulatory oversight, security vulnerabilities, and the absence of traditional consumer protections like FDIC insurance. Neo-banks and fintech platforms are often more vulnerable to cyberattacks and data breaches, which could jeopardize users’ financial data and funds. Additionally, digital-only platforms may not be able to manage systemic risks during times of economic crisis. - How is fintech innovation reshaping the banking landscape for younger generations?

Fintech innovation is reshaping the banking landscape by providing affordable, accessible, and customized financial services for younger generations. Gen Z and millennials are attracted to the speed, convenience, and low-cost nature of fintech apps like Venmo, Cash App, and Chime. These platforms offer instant payments, budgeting tools, investment options, and no-fee banking, challenging traditional banking systems and making financial services more inclusive. - What role does cybersecurity play in Gen Z’s trust of digital-only financial services?

Cybersecurity is crucial in maintaining Gen Z’s trust in digital-only financial services. While Gen Z tends to trust technology and digital solutions, data breaches, identity theft, and cyberattacks remain significant concerns. As more young people move their financial lives online, the importance of securing digital banking platforms becomes critical. Fintech companies and neo-banks must prioritize robust security measures and data privacy protocols to ensure their users feel safe and confident in using these platforms for everyday financial transactions.