Introduction: The Tug-of-War Between Saving and Spending

Introduction: The Tug-of-War Between Saving and Spending

Every Nigerian knows the struggle—your salary lands, bills rush in, and before the end of the month, your account balance looks like it has been robbed in broad daylight. You whisper promises to yourself: “Next month, I’ll be saving more.” But next month comes, and the story repeats.

This saving vs spending dilemma isn’t unique to Nigeria; people in Canada and the USA fight the same battle. But Nigeria’s unstable economy, inflation shocks, and weak credit systems make it more urgent to rethink how we manage money.

Financial experts argue that the real problem isn’t just about saving or spending—it’s about finding the right balance. Let’s dig into how Nigerians can learn from local realities while borrowing proven habits from advanced economies.

Why Saving Is Harder in Nigeria Than in Canada or the USA

When financial experts advise, “Save 20% of your income,” most Nigerians laugh. Why? Because survival often consumes everything.

Key Factors Making Saving Hard in Nigeria:

- High inflation rates – money loses value quickly.

- Unstable exchange rates – savings in naira depreciate against the dollar.

- Low income-to-expense ratio – salaries don’t match living costs.

- Cultural obligations – supporting extended families drains reserves.

- Unplanned emergencies – hospital bills, sudden hikes in school fees, or car breakdowns.

Meanwhile, in Canada and the USA, although citizens face debts and inflation, they enjoy:

- Higher average incomes.

- Access to structured retirement plans (like 401k in the US, RRSP in Canada).

- Government-backed financial education programs.

- Broader access to affordable credit.

This doesn’t mean Nigerians can’t save—it means strategies must be adaptive and creative.

Spending Blindly vs Saving Blindly: Why Both Can Be Dangerous

Most people think spending is the enemy and saving is always “good.” But experts warn: both extremes can ruin your financial health.

- Spending recklessly = short-term pleasure, long-term poverty.

- Saving blindly = false security if your money loses value to inflation.

Example:

- A Nigerian who saves ₦50,000 monthly in a regular savings account may find that inflation erodes the value within a year.

- Meanwhile, spending the same ₦50,000 on a certified skill (coding, digital marketing, fashion design) could generate future income.

Lesson? Spending smart is as important as saving smart.

The Psychology of Spending: Why Nigerians Overspend

Spending is not always about logic—it’s emotional. Nigerians, like Americans and Canadians, fall into psychological spending traps:

- Lifestyle Inflation – As income rises, expenses rise to match.

- Status Pressure – Nigerians overspend to show success (e.g., parties, gadgets, cars).

- Retail Therapy – Spending to reduce stress or feel good, even when broke.

- Cultural Generosity – A desire to help relatives, even at personal financial risk.

In contrast, Canadians and Americans also overspend but often on credit cards, leading to massive debt cycles. Nigerians overspend mostly in cash, which can feel less risky but limits long-term financial stability.

A Comparative Look: Nigeria vs Canada/USA

| Factor | Nigeria | Canada/USA |

|---|---|---|

| Inflation | High (erodes savings fast) | Moderate, hedged with financial instruments |

| Savings Tools | Mostly banks, fintech apps | Retirement accounts, stock markets, mutual funds |

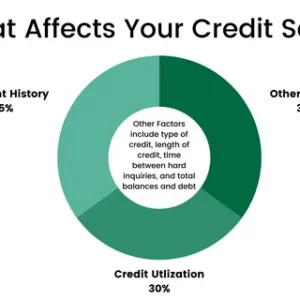

| Credit System | Limited, high-interest rates | Widespread, regulated, credit scores used |

| Spending Triggers | Cultural obligations, survival needs | Credit-fueled consumption, lifestyle inflation |

| Financial Education | Limited, informal | Institutionalized, taught in schools and workplaces |

This table shows one truth: Nigerians must be smarter with habits since the system doesn’t naturally support long-term wealth growth.

The Expert Blueprint: Balancing Saving and Spending

Financial experts often recommend the 50/30/20 rule—but Nigerians can’t copy it blindly. Instead, here’s a localized version:

- 60% for needs (food, rent, transport, utilities).

- 20% for savings/investments (even if small, it builds discipline).

- 15% for wants (entertainment, shopping—controlled enjoyment).

- 5% for giving/family obligations (so it doesn’t consume your entire budget).

This balance forces survival, growth, enjoyment, and generosity to co-exist.

Practical Steps Nigerians Can Learn from Canada & USA

1. Pay Yourself First

- Automate transfers into savings/investment accounts.

- Canadians use payroll deductions for retirement. Nigerians can set up auto-debits to PiggyVest or Cowrywise.

2. Build Emergency Funds

- Experts recommend 3–6 months of living expenses.

- Even if it’s ₦5,000 monthly, consistency matters.

- Without emergency funds, every crisis leads to debt.

3. Invest Beyond Cash Savings

- Cash loses value—diversify into:

- Mutual funds

- Government bonds

- Dollar-denominated assets

- Canadians and Americans invest heavily in stock markets; Nigerians can start small with local fintech platforms.

4. Avoid Bad Debt

- In the USA, credit cards create financial reputation.

- In Nigeria, loans are expensive and risky—use them only for investments, not consumption.

5. Spend Strategically

- Spend on:

- Education and skills.

- Business tools (laptops, tailoring machines, POS devices).

- Health (because medical debt destroys families).

Lessons from Canadian & US Experts

Experts in North America emphasize these golden rules:

- Compound Interest Is King. Early saving/investment builds exponential growth.

- Cut Emotional Spending. They call it “keeping up with the Joneses.” Nigerians can avoid “keeping up with the neighbors.”

- Seek Financial Literacy. Governments in Canada invest in financial literacy programs. Nigerians can self-educate through online platforms.

- Invest in Assets, Not Just Cash. Whether it’s real estate, index funds, or side businesses, assets protect you from inflation.

Real-Life Nigerian Scenarios

Let’s imagine two Nigerian professionals:

- Ada (The Saver): Ada saves ₦30,000 monthly in a savings account. After one year, inflation reduces her purchasing power by almost 20%. Her money is safe but weaker.

- Chinedu (The Smart Spender): Chinedu spends ₦30,000 on a graphic design course. Within six months, he earns ₦100,000 monthly from side gigs. His spending became an investment.

The lesson? Savings without strategy is passive; spending without purpose is wasteful.

Practical Tools Nigerians Can Use

- Budgeting Apps/Platforms: PiggyVest, Cowrywise, Mint (for US/Canada users).

- Investment Options: Treasury Bills, mutual funds, real estate cooperatives.

- Tracking Expenses: Spreadsheets or expense-tracking apps.

- Financial Content: Investopedia for global education.

Rethinking Habits: The Mindset Shift Nigerians Must Embrace

Changing your financial life is less about mathematics and more about habits and mindset. Nigerians, like many people globally, often repeat the same financial mistakes because money management is more emotional than logical. Experts in Canada and the USA emphasize one truth: wealth isn’t built by chance, it’s built by consistent, disciplined habits.

Here are the core habit shifts Nigerians must rethink to achieve financial freedom:

1. From Short-Term Gratification to Long-Term Discipline

Many Nigerians live by the philosophy of “enjoy today, tomorrow will sort itself out.” It’s understandable—economic instability, job insecurity, and political uncertainty make the future look blurry. But the danger is this: when tomorrow comes, unpreparedness leads to debt and poverty.

- Bad habit: Spending salaries on parties, gadgets, and “wants” before needs.

- Better habit: Practicing delayed gratification—saving or investing a portion first, enjoying later.

Lesson from Canada/USA: Retirement plans like the 401(k) in the US or RRSP in Canada thrive because people commit early to long-term contributions. Nigerians may not have those systems, but starting a disciplined savings/investment plan (even ₦5,000 monthly) creates financial security over time.

2. From Cash-Only Thinking to Asset Growth

A major habit Nigerians need to rethink is holding all wealth in cash. In a high-inflation environment, cash savings quickly lose value. This is why some households work hard, save for years, yet still feel poorer.

- Bad habit: Believing “money in the bank” equals wealth.

- Better habit: Channeling savings into assets that grow—government bonds, mutual funds, real estate cooperatives, or dollar investments.

Lesson from Canada/USA: Families don’t rely solely on cash; they diversify. Even middle-class households put money into index funds, retirement portfolios, and housing equity. Nigerians can adopt this mindset by asking: “Is my money working for me, or just sitting idle?”

3. From Reactive Spending to Proactive Budgeting

Too many Nigerians spend reactively—responding to emergencies or “what comes up” instead of planning. This leads to disorganized finances where money disappears without accountability.

- Bad habit: Spending without a budget and realizing too late that money is gone.

- Better habit: Creating a monthly budget—even if it’s handwritten in a notebook.

Lesson from Canada/USA: Budgeting apps like Mint or YNAB teach users to assign “jobs” to every dollar. Nigerians can adapt by using fintech apps like PiggyVest or by creating a simple Excel sheet. Once you see your spending clearly, you can cut waste.

4. From Cultural Obligation to Disciplined Generosity

Nigeria’s communal culture is beautiful, but it often traps people financially. Many young professionals become “family ATMs,” sending most of their salary to relatives, leaving little for themselves.

- Bad habit: Giving without boundaries, draining yourself to please family.

- Better habit: Allocating a specific percentage (5–10%) of income for giving, while protecting your financial goals.

Lesson from Canada/USA: While family obligations exist, boundaries are clearer. Nigerians can learn to say no respectfully, supporting loved ones without sinking their own financial ship.

5. From “Money as Status” to “Money as a Tool”

A dangerous Nigerian mindset is equating spending with success—buying expensive cars, flashy clothes, or throwing big parties to prove wealth. This often leads to living beyond means.

- Bad habit: Spending to impress others.

- Better habit: Spending to build capacity, not to show off.

Lesson from Canada/USA: Though lifestyle inflation exists, personal finance education teaches people to prioritize freedom over appearances. Nigerians can adopt this by asking: “Does this purchase increase my net worth or just my image?”

6. From Financial Ignorance to Financial Literacy

Many Nigerians still see finance as “too complicated,” leaving decisions to chance. Yet, in today’s world, financial literacy is survival, not luxury.

- Bad habit: Avoiding financial education, depending only on hearsay.

- Better habit: Reading, attending webinars, and using online platforms for learning.

Lesson from Canada/USA: Governments actively promote financial literacy (Canada’s Financial Literacy Strategy is a good example). Nigerians must self-educate through free resources like Investopedia and local fintech content.

7. From Fear of Risk to Calculated Investments

Many Nigerians avoid investing out of fear—scams, Ponzi schemes, or lack of trust. But avoiding all risk is itself risky.

- Bad habit: Keeping money only in cash to “stay safe.”

- Better habit: Learning to evaluate risks and diversify investments.

Lesson from Canada/USA: Risk is managed, not avoided. Canadians and Americans diversify across stocks, bonds, and retirement accounts. Nigerians can start small with Treasury bills, mutual funds, or carefully vetted cooperative societies.

8. From “Money Will Sort Itself Out” to “I Control My Money”

Perhaps the biggest mindset shift is moving from passivity to control. Too many Nigerians live paycheck-to-paycheck, hoping for miracles. But wealth creation requires intentional control.

- Bad habit: Ignoring finances until crisis hits.

- Better habit: Reviewing accounts weekly, setting goals, and tracking progress.

Lesson from Canada/USA: People actively manage finances, set annual targets, and plan for retirement decades in advance. Nigerians can adopt this by setting short, medium, and long-term goals.

Summary of Habit Shifts Nigerians Must Rethink

| Old Habit | New Habit | Global Lesson |

|---|---|---|

| Spend first, save later | Save/invest first, spend later | “Pay yourself first” (Canada/USA) |

| Cash-only mentality | Asset-based wealth | Use bonds, stocks, real estate |

| Reactive spending | Proactive budgeting | Every dollar/penny has a job |

| Unlimited family giving | Disciplined generosity | Boundaries protect wealth |

| Spending for status | Spending for growth | Value freedom, not appearances |

| Ignoring financial education | Pursuing financial literacy | Access free resources online |

| Fear of investment | Calculated, diversified risk | Risk managed, not avoided |

| Passive money mindset | Active money control | Set and track goals |

Final Thought on Habits

Financial experts insist that habits shape destiny. Nigerians cannot control inflation, unstable currency, or political shifts—but they can control how they save, spend, and invest. By rethinking old habits and borrowing practical lessons from Canada and the USA, Nigerians can escape the cycle of financial struggle and build a future that is not only secure but also prosperous.

Final Thoughts: Building Wealth the Smart Way

For Nigerians, the debate of saving vs spending isn’t about picking one side—it’s about balance. Savings protect your today, while strategic spending secures your tomorrow.

The harsh economic realities mean Nigerians can’t copy Canadian or American systems wholesale. But with discipline, financial education, and technology, we can craft personal finance habits that not only survive but thrive.

So, next time you get your paycheck, ask yourself:

👉 “Am I saving for safety, spending for growth, or wasting for status?”

The answer to that question will decide your financial future.

Frequently Asked Questions (FAQs)

1. Is it better to save in naira or dollars in Nigeria?

Saving in naira alone exposes you to inflation and currency depreciation. Many financial experts recommend keeping a portion of savings in dollar-based assets (through dollar accounts, fintech apps, or Eurobonds) to preserve value. This mirrors what Canadians and Americans do when they hedge against inflation with diversified portfolios.

2. How much of my income should I save every month?

The global standard is 20% of income, but in Nigeria, that may not always be realistic. A good approach is to start with 10% consistently, then increase gradually as income grows. Canadians often use the “pay yourself first” method, automatically deducting savings before spending. Nigerians can adopt the same principle using fintech auto-savings tools.

3. Should Nigerians prioritize paying debts before saving?

Yes—especially high-interest debts. In Nigeria, loan interest can be as high as 20–30%, which erodes financial stability. Paying off debt first ensures your money isn’t wasted on endless repayments. Canadians and Americans follow the same logic, often using the “debt snowball” or “debt avalanche” strategy.

4. How do I budget if my income is irregular?

For freelancers, traders, or gig workers, budgeting should be based on average income, not best-case scenarios. The trick is to:

- Separate needs from wants.

- Save more in “good months” to cover “slow months.”

- Use zero-based budgeting (assigning every naira a role).

This is the same strategy many self-employed Canadians and Americans use to manage irregular incomes.

5. What’s the best way for Nigerians to invest safely?

Safe investment options include:

- Government bonds and Treasury Bills.

- Mutual funds managed by trusted financial institutions.

- Cooperative investments vetted for transparency.

In Canada/USA, safe investments usually mean bonds, GICs (guaranteed investment certificates), or index funds. Nigerians should adopt similar caution—avoid Ponzi schemes, ask for licenses, and diversify.

6. How can I stop overspending when cultural pressures are high?

The key is to set boundaries. Allocate a fixed percentage (5–10%) of income for family support or cultural obligations. Once it’s exhausted, you stop giving until the next cycle. This protects you from guilt and debt. Canadians and Americans face similar pressures (e.g., helping kids with tuition), but boundaries keep generosity sustainable.