How to Stop Living Paycheck to Paycheck: Break Free with a Practical, No-BS Plan for the USA & Canada

A Quick Hook—Why This Matters Now

Living paycheck to paycheck feels like running on sand. You move a little, then slide back. Your rent clears, groceries spike, a surprise bill hits, and your account balance gasps. You promise to “do better next month,” but the next month looks the same. That loop is exhausting, but it isn’t permanent.

Here’s the good news. You don’t need a windfall to break out. You need a repeatable system that buys you space, cuts the leak, and grows a buffer. This guide gives you that system—built for real life in the United States and Canada. It blends quick wins with durable habits. It respects your time and your energy.

What “Paycheck to Paycheck” Really Means

It’s not just about a low income. Many high earners still live strapped. The defining feature is fragile cash flow. There’s little or no margin between paydays. One unexpected expense can derail your entire month.

The fix is not only “earn more” or “spend less.” The fix is better cash-flow control, debt strategy, and automatic guardrails. Each piece builds breathing room. Together, they create freedom.

The Brutal Truth—And the Spark of Hope

In the U.S., a key financial stress signal is whether a family can cover a small emergency with cash. In 2024, only 63% of adults said they could pay a $400 emergency expense with cash or its equivalent. That tells us millions still feel on edge. (Federal Reserve)

That’s the brutal truth. Here’s the hope: the numbers have improved since the pandemic low. With a handful of smart, repeatable moves, your personal numbers can improve even faster.

The One-Weekend Turnaround: Quick Wins That Raise Your Balance Fast

You can create relief in 48 hours. Don’t aim for perfect. Aim for cash.

Do these now:

- Pause one discretionary autopay. Cancel later if you still want it.

- Call your mobile provider. Ask for a retention discount or a cheaper plan.

- Shop insurance quotes. Many shave 10–20% without worse coverage.

- Switch to a no-fee bank account if you pay monthly fees.

- List a rarely used item for sale today. Price it to move.

- Change due dates to after payday to prevent overdrafts.

- Set a micro-budget for only three categories this week: food, transit, fun.

Every completed task frees money this month. You’ve created your first margin.

The 7-Day Cash-Flow Reset

A reset clears the fog and sets rails for the next 30 days. Keep it simple.

Day 1: Map Money In

- List pay dates and amounts after taxes.

- Include side income and benefits reimbursements.

Day 2: Map Money Out

- Fixed bills: rent, utilities, insurance, minimum debts.

- Variable: groceries, fuel, eating out, small online buys.

Day 3: Pick One Budget Style

- Zero-based: every dollar gets a job.

- 50/30/20: needs/wants/saving.

- Envelope/digital jars: cap categories to stop overspending.

Day 4: Automate the Essentials

- Automate minimum debt payments and rent.

- Automate weekly grocery cap.

Day 5: Build a Micro-Buffer

- Move $50–$200 into a separate savings space.

- Name it “Emergency Starter” to lock the purpose.

Day 6: Slash One Leak

- Unused subscription? Kill it.

- Insurance too high? Switch this week.

Day 7: Plan Your Next Paycheck

- Pre-assign dollars: bills, food, transit, micro-buffer.

- Leave $25–$50 unassigned for surprise smaller charges.

The Budget You’ll Actually Use (Canada-Friendly Too)

Many budgets fail because they’re tedious. Use a tool that gives clear categories, quick edits, and tips. Canadians can try the Government of Canada’s Budget Planner, which customizes budgets and offers suggestions based on your inputs. It’s free, secure, and designed for everyday use. (Canada.ca)

Make it stick:

- Keep categories few.

- Review once a week for five minutes.

- Adjust, don’t abandon, after a bad week.

Build Your First Safety Buffer

You don’t jump to a six-month fund overnight. You stair-step.

Stage 1: Micro-buffer

- Target: $250–$1,000, based on your risk.

- Purpose: block overdrafts and small shocks.

Stage 2: One-Month Cushion

- Cover rent, food, and required bills for one month.

- Use tax refunds, bonuses, or a side-gig burst to reach it.

Stage 3: Toward 3–6 Months

- Slowly add.

- Automate separate transfers on payday.

Pro tip: Keep the buffer in a separate savings space so daily spending doesn’t nibble it.

Debt, Without Shame: Two Proven Payoff Paths

Debt isn’t a moral failing. It’s a math and behavior puzzle. Solve it with a plan.

Avalanche Method

- Pay extra toward the highest interest rate first.

- Fastest payoff. Lowest total interest.

- Requires discipline when the balance is big.

Snowball Method

- Pay extra toward the smallest balance first.

- Quick wins boost motivation.

- Slightly more interest cost in exchange for momentum.

How to choose:

- If motivation is low, go snowball.

- If you’re steady and patient, go avalanche.

- Either way, automate the extra payment.

Stop the Interest Spiral (Credit Cards and Lines of Credit)

- Autopay the statement balance every month when possible.

- Request a due-date change to align with payday.

- Ask for a lower APR if you’ve paid on time for six months.

- Consider a 0% transfer only with a strict payoff schedule.

- Freeze cards digitally if you tend to impulse-spend.

Housing: Your Biggest Lever

Rent or mortgage usually dwarfs other costs. A small shift here changes everything.

Options to explore:

- Negotiate at renewal: Compare nearby listings and ask for a match.

- Downsize or relocate: Even a modest change can add hundreds monthly.

- Find a roommate: Split rent, utilities, and internet.

- Refinance or recast: If rates or terms make sense in your context.

- Utilities: Ask about equalized billing to smooth spikes.

Food and Groceries: Cut Costs Without Feeling Deprived

- Plan three repeat meals each week to use ingredients fully.

- Buy staples in bulk when the unit price is lower.

- Cook once, eat twice: dinner becomes lunch.

- Use a grocery cap: Pre-load a weekly amount on a debit card.

- Track top five items you buy most. Cut only there first.

Transportation: Quiet Savings With Big Effects

- Bundle trips to reduce gas.

- Service on schedule to improve mileage.

- Transit pass math: Compare monthly pass cost to weekly rides.

- Insurance: Ask about low-mileage discounts or telematics.

- Carpool with coworkers to split fuel and parking.

Subscriptions and Small Luxuries: The Leak You Don’t Notice

- List all subscriptions with prices and renewal dates.

- Keep your top two, cut the rest for 60–90 days.

- Replace, don’t remove: library e-books, ad-supported tiers, family plans.

- Rotate one luxury back every few months if the budget allows.

Utilities and Energy: Easy Tweaks That Lower Bills

- LED bulbs and smart plugs reduce vampire power.

- Programmable thermostat for peak times.

- Seal drafts around windows and doors.

- Laundry on cold, air-dry when possible.

- Negotiate internet speed tiers and loyalty discounts.

Phone Plans: Lower Your Rate Without Losing Coverage

- Ask for a retention plan or seasonal promo.

- Switch to prepaid or a flanker brand with the same network.

- Remove extras you never use.

- Share a family plan to split the bill fairly.

Banking Strategy: Organize Accounts for Control

Create a small “money map” with three accounts:

- Bills account

- Automate rent, utilities, insurance, minimum debts.

- Don’t use this card for daily spending.

- Spending account

- Groceries, fuel, transit, fun.

- Weekly cap keeps you honest.

- Buffer account

- Only for emergencies and true one-offs.

- Keep it separate and slightly out of sight.

Automation: The Quiet Superpower

Automation turns good intentions into default behavior.

- Automate savings the day you get paid.

- Automate minimum debt payments to protect credit.

- Automate bill pay with alerts to avoid surprises.

- Automate weekly micro-transfers to build the buffer painlessly.

Set it once. Review monthly. Tweak quarterly.

Your Paycheck in the USA: Squeeze More Take-Home Wisely

- Update Form W-4 after life changes to reduce too-large refunds.

- Use employer benefits: 401(k), Roth 401(k), HSA, FSA, commuter benefits.

- Check pay frequency: biweekly vs semimonthly can affect cash-flow timing.

- Split direct deposit: a portion to buffer, the rest to spending.

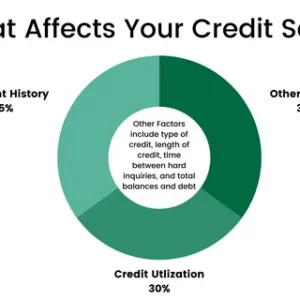

- Know your credit bureaus: Equifax, Experian, TransUnion. Audit reports regularly.

Your Paycheck in Canada: Unlock Hidden Margin

- Update your TD1 forms (federal and provincial/territorial) after life changes.

- Use RRSP, TFSA, and FHSA strategically within your limits.

- Employer plans: group RRSP, DPSP, health spending accounts, commuter programs.

- Split direct deposit between spending and savings.

- Know the bureaus: Equifax and TransUnion. Pull and correct errors.

Side-Income, Without Burning Out

You don’t need a second full-time job. You need flexible, predictable tasks.

- Freelance micro-skills: writing, editing, remote admin, basic design.

- Local gigs: tutoring, pet care, delivery, seasonal retail.

- Productize knowledge: short guides, templates, or paid workshops.

- Shift swaps: pick up extra paid shifts if benefits remain intact.

Rule of thumb: Choose work that pays enough and preserves your energy.

Raises and Promotions: How to Ask Without Cringing

- Track wins: revenue saved, revenue earned, problems solved.

- Benchmark pay using credible reports.

- Rehearse a one-minute case: role, results, requested number.

- Ask during planning cycles or after a major success.

- Be ready with options: pay, title, bonus, training budget, remote days.

Even a small raise compounds over years. The best money you earn is money you no longer need to borrow.

Comparison Table—Pick Your Next Best Move

| Strategy | Setup Time | First Savings | Monthly Gain (Typical) | Effort Level | Best For |

| Call and negotiate mobile/Internet | 20–30 minutes | Immediate | $10–$40 | Low | Anyone overpaying for data or speed |

| Insurance quote shopping | 45–60 minutes | Immediate | $20–$80 | Medium | Drivers and renters/homeowners |

| Cancel two subscriptions | 10 minutes | Immediate | $10–$30 | Low | Streaming/app collectors |

| Weekly grocery cap | 15 minutes | This week | $30–$120 | Medium | Families and roommates |

| Roommate or downsizing | 2–6 weeks | Next month | $200–$600 | High | Big city renters |

| Debt snowball/avalanche | 30 minutes | This month | Interest declines | Medium | Anyone with 2+ debts |

| Side-income micro-gig | 1–3 hours | This week | $100–$400 | Medium | Flexible evenings/weekends |

| Automate payday split | 10 minutes | This month | $50–$200 to savings | Low | Everyone, always |

Estimates vary by city, province/state, and personal situation.

Cash-Flow Calendars: See Trouble Before It Hits

A simple cash-flow calendar maps pay dates and due dates. It prevents two bad surprises:

- Stacked bills just before payday.

- Auto-debits that pull your balance negative.

How to set one up:

- Write each payday on a calendar.

- Place each bill on its due date.

- Move one or two due dates to balance the month.

- Add a small “just-in-case” buffer near tight weeks.

You’ll see stress points before they become fees.

Overdrafts and Fees: A Quiet Tax on the Paycheck Loop

- Turn off overdraft “protection.” It often isn’t protective.

- Use account alerts for low balances.

- Prefer no-fee accounts when possible.

- Avoid cash advances on credit cards. The fees and APRs are steep.

- Know your ATM network to avoid out-of-network charges.

Fees are controllable. Keep your money.

Children, Caregiving, and Household Logistics

- Meal prep in batches to save time and money.

- Swap childcare with friends for free breaks.

- Buy used first: kids grow faster than clothes last.

- Ask schools about low-cost activity aid and lunch programs.

- Automate the essentials so mental load stays manageable.

Health Costs: Small Steps That Prevent Big Bills

- Use preventive care covered by your plan.

- Compare pharmacies for prescription prices.

- Ask for generics when appropriate.

- HSA or FSA (U.S.) and health spending accounts (Canada) can stretch dollars.

- Check coverage before procedures to avoid surprise bills.

When Debt Becomes Hard to Manage

- Call your lender early if you might miss a payment.

- Ask for hardship options: deferrals, interest relief, extended terms.

- Non-profit credit counseling can negotiate lower payments.

- Avoid high-cost loans that trap you deeper.

- Document everything: dates, names, terms offered.

Shame keeps people stuck. Asking for help gets you moving again.

Your Mindset: Small Wins, Repeated

Money change is behavior change. You don’t need perfect days. You need consistent better days.

- Measure what matters: cash buffer, debt balance, and bill-to-income ratio.

- Celebrate small wins: a lower bill, a canceled autoplay.

- Set friction: remove saved cards from impulse-buy sites.

- Use a “cool-off” rule: wait 24 hours before any purchase over $50.

The One-Page Weekly Money Review

Keep review simple. Ten minutes, once a week.

- Check account balances and upcoming bills.

- Confirm transfers to savings and debts happened.

- Scan spending for one thing you’ll change next week.

- Pick one action: negotiate, cancel, or plan meals.

- Note your win: what went right this week.

Repeat for 12 weeks. Your finances will feel different.

Scripts You Can Use Today (Phone or Chat)

Mobile/Internet Retention Script

“Hi, I’ve been a loyal customer, but my bill is high. I see competitors at $XX. Can you review my account for a retention offer or a lower-priced plan? I’m happy to stay if we can land closer to that.”

Insurance Quote Script

“I’m comparing rates with the same coverage. Can you check for discounts I qualify for—safe driver, low mileage, or loyalty? If we can lower the premium by even 10–15%, I would prefer to stay.”

Landlord Renewal Script

“My rent is up for renewal. Comparable units nearby are listed at $X–$Y. I’ve been a great tenant and pay on time. Can we renew at a rate closer to the market?”

USA vs. Canada—Same Goal, Different Tools

United States

- 401(k) and Roth 401(k): pre-tax or tax-free growth.

- HSA/FSA: set aside pre-tax dollars for eligible health costs.

- Credit Reports: Equifax, Experian, TransUnion—pull each annually.

- Commuter Benefits: pre-tax transit and parking in many regions.

Canada

- RRSP: contributions reduce taxable income within limits.

- TFSA: tax-free growth and withdrawals within limits.

- FHSA: for first-home saving with tax advantages.

- Credit Reports: Equifax and TransUnion—review both annually.

Use the right account for your country, then automate contributions.

Your First 30 Days: A Realistic Roadmap

Week 1

- Do the one-week reset steps.

- Cancel two subscriptions.

- Negotiate phone or internet.

Week 2

- Automate bill pay and minimum debts.

- Start $25–$50 automated savings.

Week 3

- Choose avalanche or snowball.

- Add $25–$100 extra to the target debt.

Week 4

- List one item for sale.

- Plan five dinners that repeat ingredients.

- Do the one-page weekly review.

Small actions, big relief.

Guardrails: The “No-Regrets” Rules

- Never carry a credit card balance to fund wants.

- Always keep a small buffer separate.

- Avoid payday loans and expensive cash advances.

- Prefer automation over willpower.

- Check statements monthly for errors and fraud.

These rules protect you when life gets loud.

If You’re Paid Weekly, Biweekly, or Semimonthly

Misaligned pay and bill cycles cause chaos. Fix the alignment.

- Move two or three due dates to evenly spread across the month.

- Use the “extra paycheck” months for savings or debt bursts.

- Split deposits so essentials are covered first.

A few calls now prevent many panicked nights later.

When Income Is Variable

Freelancers, gig workers, and shift workers can build stability.

- Base your budget on your lowest predictable income.

- Create a “smoothing” fund to top up thin weeks.

- Pre-save taxes in a separate account.

- Batch fixed bills right after your strongest earning days.

Consistency beats intensity.

Financial Stress Is Health Stress—Protect Both

- Sleep and money reinforce each other. A clear plan reduces anxiety.

- Move your body for mood and resilience.

- Share the load with a trusted friend or partner.

- Set boundaries at work and with spending triggers.

You’re building a life, not just a ledger.

Motivation Boosters That Don’t Cost Money

- Progress bar: track one metric you care about.

- 15-minute money sprint: tidy transactions and plan tomorrow’s meals.

- Gamify bills: how many can you reduce this month?

- Future letter: write to yourself from a calm, debt-light future.

Energy creates money momentum.

Common Pitfalls—and How to Dodge Them

- All-or-nothing thinking: one slip isn’t failure. Reset next swipe.

- Overcomplicated budgets: too many categories breeds quitting.

- Hiding from statements: open them weekly, even if it stings.

- Big changes overnight: stack small changes you can keep.

- Lifestyle creep: give raises a job before they arrive.

Frequently Asked Questions (Short, Direct Answers)

1) How much should my first emergency fund be?

Start with $250–$1,000. Then grow to one month of expenses. Keep building when you can.

2) Should I invest while in credit card debt?

Usually no. Pay high-interest debt first. Contribute enough to employer retirement matches if available.

3) Which debt method is better—snowball or avalanche?

Avalanche is cheapest; snowball is easiest to sustain. Choose the one you’ll actually follow.

4) How do I budget if my income changes every week?

Budget to your lowest predictable income. Use a small “smoothing” fund to top up lean weeks.

5) What if my partner won’t budget?

Align on shared goals first, like fewer money fights. Start with one joint habit, like a weekly 10-minute review.

6) How long before I feel a difference?

Many feel relief in two to four weeks once automation and quick wins kick in.

Two Authoritative Resources, When You’re Ready for More

- For a snapshot of American households’ financial resilience, see the Federal Reserve’s annual report on household well-being. It tracks the share of adults who can cover a $400 emergency with cash. (Federal Reserve)

- For a free, Canada-specific budgeting tool with tips and charts, try the Financial Consumer Agency of Canada’s Budget Planner. It helps you build a custom plan in minutes. (Canada.ca)

Your Momentum Checklist (Save or Screenshot)

- Cancel two subscriptions today.

- Negotiate one bill this week.

- Automate $25–$50 to savings on payday.

- Choose snowball or avalanche. Automate the extra payment.

- Create a cash-flow calendar with pay and due dates.

- Do a 10-minute weekly money review.

- Celebrate one small win each week for 12 weeks.

The Final Word—Freedom Comes from System, Not Willpower

Living paycheck to paycheck isn’t a verdict on your worth. It’s a pattern that responds to better patterns. You don’t need perfect discipline or a giant salary jump to breathe again. You need a system that captures quick wins, protects your cash flow, and grows a buffer while you sleep.

Start with one step today. Then stack the next one tomorrow. Tiny, repeatable changes will do what big, heroic efforts can’t sustain. Your future self is already grateful.

FAQs on How to Stop Living Paycheck to Paycheck

1. How do I know if I’m truly living paycheck to paycheck?

If your income barely covers expenses, you have little savings, and an unexpected $200–$400 bill would derail your month—you’re living paycheck to paycheck.

2. What’s the fastest way to break the cycle?

Start with quick wins: cancel unused subscriptions, negotiate bills, and create a small savings buffer of $250–$500. These small changes reduce pressure fast.

3. How much should I save before focusing on debt?

Build a micro-emergency fund first ($250–$1,000). Once you have that cushion, focus on high-interest debt repayment using avalanche or snowball methods.

4. Which budgeting method works best if I hate numbers?

Try the 50/30/20 rule—spend 50% on needs, 30% on wants, and 20% on saving/debt. It’s simple and doesn’t require micromanaging every expense.

5. Can I still enjoy life while trying to save money?

Yes. Keep one or two low-cost luxuries, like a streaming service or weekly coffee. The key is intentional spending, not total deprivation.

6. How long does it take to stop living paycheck to paycheck?

For many, relief comes in 1–3 months once bills are streamlined and savings automation is set up. A full transformation may take a year or more.

7. Is it better to earn more or cut expenses?

Both help. Cutting expenses gives immediate relief, while earning more (through raises, side gigs, or promotions) builds long-term stability.

8. What if my income is unpredictable, like freelance or gig work?

Base your budget on your lowest predictable income. Use a smoothing fund to balance high and low earning weeks.

9. How do I resist the urge to overspend after payday?

Automate transfers to savings and bills the same day you’re paid. That way, only discretionary money stays in your spending account.

10. What’s the end goal of all these steps?

The goal is freedom—where bills don’t scare you, surprises don’t break you, and you can plan for the future with confidence.