🔥 How to Raise Your Credit Score Fast: The Straight Talk

You’ve clicked this article because you’re frustrated—maybe your credit score is holding you back from that dream home, apartment, car loan, or better interest rates. You’ve probably tried bits and pieces of advice here and there, but you want a roadmap you can act on now. The good news: while there’s no “instant magic reboot,” smart, targeted action can cause visible improvements within weeks to months. In this article, I’ll walk you through proven steps, highlight common traps, and arm you with tools to take charge of your credit score in the USA and Canada.

Let’s begin with what’s going on behind the scenes of your credit score—and then move into the fast-track strategies that actually work.

Understanding the Landscape: What Affects Your Credit Score?

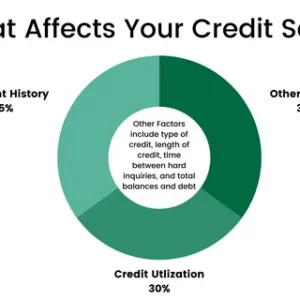

Before you try to “hack” your score, you need to understand the levers. Here are the major components (roughly how FICO / Vantage / Canadian scoring models allocate weight):

| Factor | Approximate Weight | Why It Matters |

|---|---|---|

| Payment History | ~ 35% | Late or missed payments are red flags to lenders |

| Credit Utilization / Balances | ~ 25-30% | How much of your available credit is actually used |

| Length of Credit History | ~ 15% | Older, well-managed accounts show stability |

| Credit Mix | ~ 10% | A healthy variation (e.g., credit cards, installment loans) |

| New Credit / Inquiries | ~ 10% | Hard inquiries and opening many accounts signals risk |

These aren’t universally identical between U.S. and Canadian scoring models, but the principles hold. Experian calls out on-time payments, paying down balances, and avoiding unnecessary new debt as key ways to improve your score. (Experian)

In Canada, TransUnion recommends paying bills on time, watching your card balances, and being cautious with new applications. (TransUnion)

Also, the Government of Canada emphasizes not exceeding 30% of your credit limit. (Canada.ca)

So now you know what you want to influence. Let’s go step by step through how to push those levers—fast.

🚀 Fast but Real: 7 Strategies to Accelerate Your Credit Score Growth

Here are the tactics that can produce relatively speedy results—when done correctly.

1. Pay Down Balances, Strategically and Often

One of the fastest-impact moves is to reduce your credit utilization. If you’re using 50% or more of your available credit, that’s a signal of risk—even if you always pay your full balance. NerdWallet calls utilization the “second-biggest factor” behind payment history. (NerdWallet)

- Aim for utilization under 30%, ideally under 10–20%, especially before your creditor reports to bureaus.

- If possible, make multiple payments per month so your outstanding balance at reporting time is low.

- Focus on paying down the highest-balance/high-interest card first (“avalanche method”).

2. Pay More Frequently or “Before Due Date”

Instead of waiting until your full due date, you can make early payments or split payments across the month. That keeps your reported balances lower when the creditor sends data to credit bureaus.

Equifax suggests paying bills more frequently, not just once a month. (Equifax)

If you know the date your issuer reports to the bureaus (sometimes indicated on your statement), aim to have a lower balance just before that date. (cwbank.com)

3. Request a Credit Limit Increase (Without Spending More)

If your income or credit situation has improved, ask your card issuer for a limit boost. If granted (and you don’t use the extra credit), your utilization ratio drops instantly.

Be careful: some limit increase requests result in a hard inquiry, which may temporarily ding your score. Ask whether the issuer will do a “soft pull.”

This tactic is widely suggested by financial experts for its near-immediate effect when implemented responsibly. (NerdWallet)

4. Don’t Slash Old Accounts – Keep Them Alive

Closing old credit accounts can reduce your average age of accounts and decrease your total available credit, both of which can hurt your score.

TD Bank warns against canceling cards because length of credit history matters. (TD Canada Trust)

Likewise, Equifax suggests keeping old accounts open even if you don’t use them frequently. (equifax.ca)

If inactivity is a concern, use them occasionally with a small purchase and pay off immediately.

5. Become an Authorized User (Or Add Someone You Trust)

If someone close to you (a parent, spouse) has a credit card with a long history of on-time payments and low utilization, being added as an authorized user can transfer some of that positive history onto your report.

NerdWallet approves this technique—assuming the credit issuer reports authorized users to all credit bureaus. (NerdWallet)

It’s a low-effort boost especially for newer credit users, though the effect is smaller for those with established credit.

6. Dispute Errors and Negotiate for Deletions

Mistakes—incorrect late payments, duplicates, old accounts listed incorrectly—can drag your score. Request your credit report(s), review carefully, and submit disputes.

- In the U.S., use AnnualCreditReport.com to pull free reports and address errors.

- In Canada, you can request your free reports from Equifax and TransUnion. (Canada.ca)

If a debt is valid but small, sometimes you can negotiate with the creditor to remove the negative mark in exchange for payment (a “pay for delete” approach). Be cautious: this must be documented in writing.

7. Use “Credit Boost” Tools, Rent / Utilities Reporting (Where Available)

Some tools let you report non-traditional payments—like rent, cell phone, utilities—so they count positively in your credit history.

- In the U.S., Experian Boost allows you to report on-time utility and telecom payments to help raise your credit score.

- In Canada, services like credit rent-reporting platforms can help when landlords or agencies report payments. (Some Canadians report using services to report rent timely payments. (Reddit))

This won’t move your score dramatically overnight, but it can help especially if your credit profile is thin.

⚖️ Comparing the Speed & Risk of Each Strategy

Not all tactics are created equal in terms of speed, risk, or effort. Here’s a comparative view:

| Strategy | Speed Potential | Risk / Cost | Best For |

|---|---|---|---|

| Pay down balances | 1–2 billing cycles | Little risk (just cash flow) | Everyone |

| Frequent / early payments | 1 billing cycle | Requires discipline | Those with cash flow |

| Credit limit increase | Next reporting cycle | Hard pull (if handled poorly) | Users with good standing |

| Keeping old accounts | Long term, cumulative | Minimal | Established users |

| Authorized user addition | 1–2 cycles | Dependent on another’s behavior | Newer users |

| Dispute errors / removal | 1–3 months | Could be rejected or slow | All users |

| Rent/utilities reporting | 1–2 cycles (or more) | Requires setup or paid service | Thin-file holders |

Note: Speed depends on when issuers report to bureaus. Results may show in 30–60 days for many tactics, but it also depends on how recently your credit was assessed.

Addressing Key Pain Points & Readers’ Concerns

Let’s tackle the specific worries you’re probably wrestling with—and offer solutions.

“I’m living paycheck to paycheck—how can I pay down balances fast?”

- Start with small but consistent extra payments rather than lump sums.

- Use windfalls or irregular income (tax refunds, bonuses, gifts) to accelerate payments.

- Focus on one card (the one with the highest balance or interest) and use the “snowball” or “avalanche” method.

- Temporarily cut non-essentials to funnel extra dollars toward debt.

“What if I have missed payments or collections already?”

- If the missed payment is recent, bring the account current immediately.

- If it’s in collections, negotiate with the collection agency for partial settlement or pay-for-delete (get it in writing).

- Dispute any incorrect entries or outdated listings on your report.

- Rebuild slowly: even after late marks, good subsequent behavior matters heavily.

“Will opening a new credit card help—or hurt?”

Opening a card gives you more available credit (lower utilization), but also triggers a hard inquiry and shortens your average account age.

If you do open, ensure:

- You genuinely need the credit (not just for score gaming).

- It’s from a reputable issuer.

- You use it responsibly and pay off in full, quickly.

“Is hiring a credit repair company better?”

Credit repair companies cannot legally do anything you can’t do yourself. Beware of scams, and understand that legitimate companies just help with DIY actions (e.g., writing disputes). (Investopedia)

Doing it yourself saves money and gives you control.

“How fast is fast, really?”

You might see improvements in 30–90 days if you aggressively reduce utilization, fix errors, and maintain perfect payment behavior. However, building a strong, lasting credit score is a multi-month to year process. Be skeptical of claims of 100+ point jumps overnight.

Putting It All Together: A 90-Day Action Plan

Here’s a suggested schedule to follow if you want to see measurable progress:

| Period | Focus | Milestones |

|---|---|---|

| Days 1–7 | Get your credit reports (U.S. or Canada), review, flag errors | Dispute mistakes, request removal or correction |

| Days 8–14 | Map out all balances, identify high-utilization accounts | Decide which to pay down first |

| Days 15–30 | Start paying extra on selected accounts; contact issuers for limit increases | Use early payments, maintain low utilization |

| Days 31–60 | Monitor updated credit reports, verify corrections | Add rent/utilities reporting (if possible) |

| Days 61–90 | Consider becoming an authorized user or cautiously opening new credit if needed | Track score changes, adjust plan |

Adjust this timeline based on your personal finances, but keep the momentum.

Common Mistakes That Derail Credit Improvement — And How to Avoid Them

- Dispute everything indiscriminately: Only dispute items you genuinely believe are inaccurate, or you risk rejection fatigue.

- Cancel old cards to “simplify”: This can shorten your history and reduce credit availability.

- Max out new lines just because you have them: If you use the extra limits, you destroy the benefit.

- Apply for too many accounts at once: Multiple hard inquiries look suspicious.

- Overlook small debts or forgotten accounts: Even a small missed payment can drag you down.

- Ignore documentation: Always keep proof of payments and correspondence when disputing or negotiating.

Summary & Final Thoughts

Raising your credit score fast is absolutely possible—but only if you’re strategic, consistent, and realistic. The “magic” comes from aligning multiple proven tactics: lowering utilization, paying more frequently, keeping aged accounts open, fixing errors, and introducing positive history (via authorized user status or nontraditional payments).

Don’t forget: momentum counts. One perfect month doesn’t erase two years of poor habits, but a dozen consistent ones will gradually change your trajectory.

Stay patient, disciplined, and proactive—monitor progress every 30 days. And if you ever feel overwhelmed, break it down into one card at a time, one payment at a time.

Your credit score is not destiny—it’s a reflection of ongoing choices. Take control today.

❓ Frequently Asked Questions (FAQs)

1. How soon can my credit score rise if I follow these tips?

You may see improvements in 30–60 days, especially by lowering utilization and ensuring on-time payments. Bigger changes (100+ point jumps) typically take several months.

2. Should I pay down small balances first or high-interest ones?

Choose your approach: the snowball method (smallest balance first) can boost motivation; the avalanche method (highest interest first) saves money. Both help reduce utilization.

3. Will becoming an authorized user always help my score?

Not always—your benefit depends on whether the issuer reports authorized user status and whether that account has good history. It’s more effective for those with thin or weak credit files.

4. Can utilities or rent payments really help my credit?

Yes—with special tools (e.g. Experian Boost in the U.S.) or rent-reporting services in Canada, timely payments may be added to your credit history. But not all landlords or utilities report by default, so check first.

5. Is it safe to negotiate “pay-for-delete” with a creditor or collection agency?

It can work, but only accept it in writing before you pay. The creditor must agree to remove the negative mark in exchange for payment or settlement. Be cautious and keep documentation.